Status Indians and Taxes

It’s tax time and that means tax pain, as the television commercials say. Tax time is also the time of year that one hears the common myth that...

Every year when the calendar rolls over to tax time, the old refrain “Indians* don’t pay taxes” is trotted out by Canadians who truly believe the Indigenous population benefits unfairly from federal law. This is the most frequently quoted myth regarding Indigenous people. Because of its popularity, we decided to provide a historical context about tax exemptions. *We do not generally use the term “Indian” as some may find it incorrect and insulting, but for the purposes of this article, we use it as that is the terminology used in the Indian Act, which we reference here. Also, please keep in mind that we are not tax experts; contact a Canada Revenue Agency office with any questions you may have.

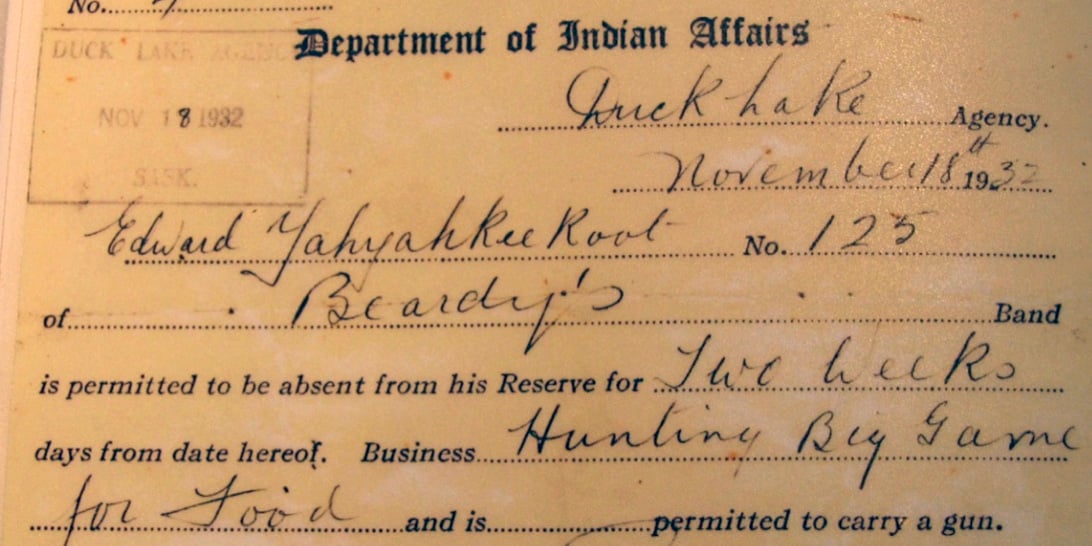

The federal government has controlled most aspects of the lives of Indians since Canada was created in 1867, and since 1878, it has done so via the Indian Act. When we say most aspects, that includes land, governance (unless the Nation has moved to self-governance), resources, status, education, wills, band administration and yes, taxes. The Indian Act formerly had a far tighter, vice-like grip on the lives of Indians than it has today. For a perspective on the realm of control, please read 21 Things™ You May Not Have Known About the Indian Act.

Before we begin, it’s important to point out that only a “Status Indian” or a “band” can claim the Section 87 exemption. In other words, non-status Indians, tribal councils, Métis, and Inuit are not eligible for the section 87 exemption. A corporation, even if all of its shareholders are Indians, is not an Indian or a band and therefore is not entitled to the Section 87 exemption. The same restriction applies to a trust.

Indian tax exemptions are laid out in Section 87 of the Indian Act. Section 87 (which has been modified over time) was introduced in 1817 - a full sixty years before Confederation and 100 years before income tax was first introduced in Canada (1917).

Section 87:

(1) Notwithstanding any other Act of Parliament or any Act of the legislature of a province, but subject to section 83, the following property is exempt from taxation, namely,

(a) the interest of an Indian or a band in reserve lands or surrendered lands; and

(b) the personal property of an Indian or a band situated on a reserve.

(2) No Indian or band is subject to taxation in respect of the ownership, occupation, possession or use of any property mentioned in paragraph (l)(a) or (b) or is otherwise subject to taxation in respect of any such property [1]

The courts have determined that, for the purposes of section 87 of the Indian Act, employment income is personal property. In the case of employment income earned by an Indian, therefore, what must be determined is whether the employment income is situated on a reserve. The courts have directed that connecting factors must be considered when making this determination. Revenue Canada, after receiving representations from interested Indian groups and individuals, has identified a number of connecting factors that can be used to determine whether employment income is situated on a reserve. [2]

For the full description of the Guidelines, please visit the Canada Revenue Agency website. (emphasis added)

Over the decades, through the course of many legal challenges, the interpretation of Section 87 of the Indian Act exemption has been narrowed by the courts. There now is required a high degree of “connecting factors” to a reserve in order for employment income to be tax-exempt. So, in a nutshell, Status Indians are subject to the same tax rules as other Canadians, apart from income earned while working on a reserve, and that income must fulfill all the required guidelines.

We asked the Canada Revenue Agency (CRA) how many Status Indians applied for the tax exemption in the 2015 fiscal year, and here's their reply:

The number of individuals who have a reported amount for the “exempted income for a Status Indian” in box 71 of their T4 slip, for the 2014 tax year, is 102,370. This number consists of returns processed up until January 29, 2016, and is rounded to the nearest 10.

This figure does not represent the full population of individuals whose income may qualify for a tax exemption*. It is incomplete and underestimates the number of Status Indians who benefit from the exemption, as individuals with exempt income* who do not meet the mandatory filing requirements (see link below), and who do not claim benefits may not be required to file an income tax return.

*exempt from tax under paragraph 81 (1(a) of the Income Tax Act and section 87 of the Indian Act.

The following is a list of requirements for filing a return in 2015:For more information, please visit: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/flng-blgtns/menu-eng.html.

- You have to pay tax for 2015.

- We sent you a request to file a return.

- You and your spouse or common-law partner elected to split pension income for 2015. See lines 115, 116, 129, and 210.

- You received working income tax benefit (WITB) advance payments in 2015.

- You disposed of capital property in 2015 (for example, if you sold real estate or shares) or you realized a taxable capital gain (for example, if a mutual fund or trust attributed income to you, or you are reporting a capital gains reserve you claimed on your 2014 return).

- You have to repay any of your old age security or employment insurance benefits. See line 235.

- You have not repaid all amounts withdrawn from your registered retirement savings plan (RRSP) under the Home Buyers’ Plan or the Lifelong Learning Plan. For more information, go to Home Buyers' Plan (HBP) or see Guide RC4112, Lifelong Learning Plan (LLP).

- You have to contribute to the Canada Pension Plan (CPP). This can apply if for 2015 the total of your net self-employment income and pensionable employment income is more than $3,500. See line 222.

- You are paying employment insurance premiums on self-employment and other eligible earnings. See lines 317 and 430.

If you have tax-related questions, please contact a CRA office or a certified accountant.

Article updated: April 18, 2016

[1] Indian Act

[2] Canada Revenue Agency

Featured photo: Unsplash

It’s tax time and that means tax pain, as the television commercials say. Tax time is also the time of year that one hears the common myth that...

The great aim of our legislation has been to do away with the tribal system and assimilate the Indian people in all respects with the other...

We identify ourselves in many ways - by gender, generation, ethnicity, culture, religion, profession/employment, nationality, locality, language,...